Why Following the Crowd is Stupid: how speculation bubbles and manias busted fortunes 400 years ago and ever since

Introduction

Most people do very little original research when it comes to investing. They usually follow the advice of someone, could be friends, family, or even someone on TV. Unfortunately, this, as proven by history, is often a VERY bad idea, because this is speculating on public mood swings, and mood swings are fickle. Fortunes have been lost, and nations ruined by speculation, even hundreds of years ago.

In this article, we will go over some significant speculation bubbles in history, how they busted, and how the lessons were not learned but should have been. And at the end, we'll explain why following in someone else's footsteps in investing is often not a good idea.

What is a "call option"?

A "call option" is basically a bet that the prices for a particular item will go up, so you want to lock in the prices now. Let's take an example.

Let's say there's 100 shares of stock X at $50 per share. You think the stocks will go up by a lot, say, 100%, but you don't have 5000 dollars to buy the stocks and profit from it later. Instead, you pay the owner of 100 shares of stock X $1000 to HOLD the stock for you for 30 days, at the current price of $50.

A few days later, stock X indeed doubled in price to $100. You choose to exercise the option by lining up a buyer for 100 shares of stock X at $100 (or $10000) the market price, while buying the stocks at $5000. So your profit is $4000 (you get $5000 difference, minus the $1000 option cost). You spent $1000 and made $4000.

If you had $5000 and bought the stock, and resold it at $10000, you'd spent $5000 to make $5000.

You can see why people would go crazy over this "call option" idea... but it's also risky. If prices do NOT go up, you lose the $1000 altogether.

What is "short selling"?

Short selling is similar but NOT an exact opposite of call option (that'd be the "put option"), basically a bet that the prices are going DOWN. So you will sell stocks (that you don't have) now at a high price, and buy back when the prices are lower.

Using Stock X as an example, let's say you know prices of stock X will drop by 50% soon. It's now at $100.

What you do is you "sell short" 100 shares of stock X, by "borrowing" someone else's 100 shares of stock X at $10000. A few days later, stock X is at $50, you buy it back at that price ($5000) and pay back the stocks, pocketing the difference of $5000, minus whatever "fees"

Clearly, if the stocks don't drop, or even RISE in value, you are on the hook for the difference. Thus, it is a very risky move.

Tulip Mania (circa early 1600's)

The Tulip Mania was generally recognized as the first economic bubble documented in detail by historians and economists.

Tulips were not native to Holland. A botany professor brought them from Turkey (then the Ottoman Empire) in 1593. Over the next decade or so, tulips slowly became popularized as a hobby for the rich, and the multi-color variants are valued more than the single colored versions. A virus, known as the mosaic virus, added color patterns to the plants, which made them highly prized. Merchants started to speculate on which variety would sell the most next year and try to "stock up" on them. This essentially created the first popular "futures" market, where traders try to "lock in" prices before next season. Prices started to rise, and the special breeds with special patterns demanded astronomical prices.

By the 1630's, people, from regular clerks and housewives to noblemen all dabbled in tulip trading. People are no longer just growing tulips, but actually TRADING them, bidding on them, speculating on their worth, and gave up fortunes to buy bulbs that they believed would make them even richer. A new innovation in economic tools at the time, the "call option", a form of leverage, only made things worse. (Its counterpart, the short selling, was outlawed by Dutch government earlier.) People who don't believe in the tulip prices continuing to rise had to eat their hats as prices kept on rising, and rising... and soon they themselves are enticed to join in, as "everybody else" seem to be doing it.

The price increased to stratospheric levels in 1637, when in January alone, prices of some tulip bulbs went up TWENTY-FOLD, in a single month. And that's the summit. People decided they really can't risk it rising higher further still. So they sold out, which caused another group to sell out, and the effect snowballed. Next month, prices took a tumble. No, it actually fell off a cliff. Prices dropped MORE THAN twenty-fold.

Government tried issuing statements to calm the market, but didn't help at all. Dealers went bankrupt and refused to honor their "options" to buy some bulbs, which lead to further bankruptcies all over the nation. Dutch government tried to make things easier by passing a law allowing people to void purchase contracts for a 10% fee, but that didn't help much. Many judges simply regarded the contracts to buy the bulbs as "gambling", and therefore completely unenforceable.

Eventually, the tulip bulb prices settled to that of the common onion before 1637 ended. Thus ended the (generally) first documented speculation bubble.

[Read more about Tulip Mania on Wikipedia]

What lessons are you supposed to take away from this?

- Leverage, such as options, allow speculators to operate more freely, as capital is less of a limiting factor.

- Bubbles generally involve items that has little intrinsic value, but instead, were bid up by speculation to unsustainable levels

- When a bubble bust, prices drop, and fortunes are ruined, and effects always snowball, as the effect cascade throughout the country across strata of people

- Government intervention almost always comes too late, even back then

South Sea Bubble's neighbor, the Mississippi Company (Circa 1719)

The Mississippi Company, which had existed a while back, was purchased by John Law, who was then owner of "General Private Bank" of France, circa 1716. Ostensibly it is to help the French colony in North America. However, he soon reorganized a new stock company, which took the name "The Mississippi Company". This company, through a few mergers, gained virtual monopoly over French trade outside Europe through Royal decree.

John Law is a shrewd marketer and touted the new world as a paradise with untold profits to be realized, which drove up his company's stock prices, and his bank also printed a lot of paper currency, so much that it cannot be covered by the gold and silver reserves he held... or even by the royal treasury of France. This lead to hyperinflation that the rapid devaluation of the currency caused people to attempt to exchange the suddenly worthless currency for gold and silver at his bank (a "bank run"). He had to suspend payment, and was then dismissed by then regent of France, forcing him into exile.

Technically, this is not a bubble, but it is related to the South Sea Bubble as the British look at Mississippi Company and decided they need to invest in their own native company, and that means the South Sea Company. So they are somewhat related.

[ Read more about how the Mississippi Company went under on Investopedia ]

The South Sea Bubble (circa early 1700's)

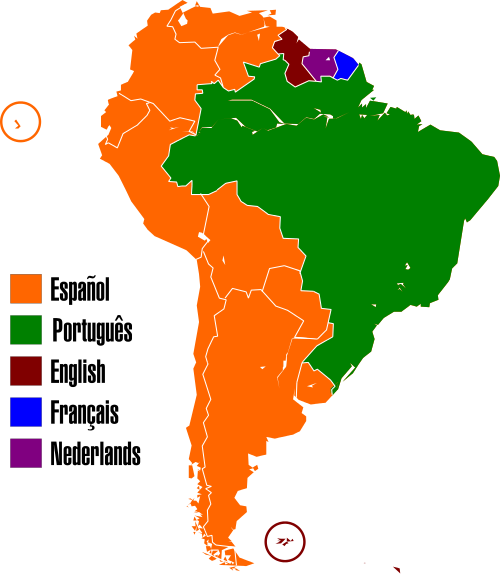

The South Sea Company was formed in England in 1711 by then Lord Treasurer Robert Harley, basically Finance Minister of the British government. At the time, the British government was heavily in debt fighting a war with Spain, but the country as a whole had decades of prosperity and most people are at least moderately affluent, but have no investment outlet. Harley cannot form a bank because Bank of England was the only bank allowed by law. So he formed the South Sea Company, which promised to pay the British government $10 million pounds, in exchange for trade monopoly in the "south seas", and an annual payment from the British government (at about 6% interest). Back then, "South Seas" basically means South America. People who hold British government debt are asked to exchange it for South Seas Company stock instead.

In reality, none of the South Sea's directors know anything about trade with South America. However, such companies are warmly greeted by the public, who are demanding outlets for their money. And the directors knew that impressions will influence public opinion, so they rented a very pretty house in London with some of the most expensive furniture available. And despite a few mistakes, they managed to kept the stock prices stable, despite a new war with Spain which lead to suspension of trade.

In 1720, when the war with Spain concluded, the South Sea directors announced they will assume the ENTIRE British national debt, then valued at 31 million pounds, and the public loved it. When the bill was introduced in parliament stating so, South Sea stock nearly TRIPLED in value. Public was just eating it up.

And South Sea directors decided to sweeten the pot with some backroom deals: if the folks who can influence the decision support the bill, they will be provided FREE OPTIONS on South Sea stock... with the requirement that if the prices went up, they must be sold back to South Sea itself... they can pocket any profit generated by the rise in prices. The bill passed, of course. It was documented that South Seas may have paid up to 1.7 million pounds in bribes and such to get the bill passed.

South Sea directors also introduced installment plans for people who want South Sea stock, then worth about 300 pounds per share. Just pay 60 now, and the rest in 8 easy payments. Investors actually fought (with fists) to get the new stock issues. South Sea soon re-issued at 400, then 600, then 800... but investors want more. Eventually the stock prices leveled off at almost 1000, and half of British parliament owned shares in South Sea.

During this mania period, many more companies issued stock. At least one was documented stating that it is "a company for carrying out an undertaking of great advantage, but nobody to know what it is". That didn't stop thousands of people from handing over their money to buy stock for this non-existent company. The director quickly packed up and disappeared with the money.

In summer of 1720, people started to see the writing on the wall, and sold off their shares. This lead to snowball of sell-offs, and the South Sea stock prices dropped off a cliff. It doesn't help that the previous "installment plans" have payments came due, and may people who can't afford to pay up sold out, adding to the snowball. The price dropped all the way back down to 100 by end of 1721. Government announcements trying to prop up South Sea had no effect. In another two months, the collapse spread to other sectors, when banks and other lenders cannot collect on the loans made out to individuals holding stocks that lost most of its value.

Many fortunes were lost. Among the victims were Sir Isaac Newton, who provided the famous quote still heard today:

"I can calculate the motions of heavenly bodies, but not the madness of people."

It was believed that Sir Isaac Newton lost over 20000 Pounds (equivalent to 3 million Pounds today) in this scheme, though it was never documented definitively.

As a result of this, British Parliament forbade common companies from issuing stock except through act of Parliament or Royal Charter for over a century. The law, popularly known as "Bubble Act", was not repealed until 1825. Most of the then British government was investigated and many high ministers and cabinet post members were impeached for fraud, and many went to prison and/or died in disgrace.

The South Sea Company itself survived until 1850, when it was finally disbanded.

[ Read more about the South Sea Bubble on Wikipedia ]

Lessons to take away?

- Public opinion can be manipulated by appearances and a few choice announcements and by publicizing the people who had already invested

- People don't do much research, if any, on whether the company's viable or not

- Excessive credit leads to heavy speculation, which then leads to a bust

- Backroom deals and bribes are bad for the public when they are kept from the public

- Government, or at least a part of it, can be involved in the bubble

British Railway Mania (circa late 1840's)

British railway started in 1830 with Manchester and Liverpool Railway, but a period of economic downturn and high interest rate made business investment unattractive, as government bonds have much lower risk and decent rewards. However, by mid 1840's, banks cut interest rates, and economy improved, and various business ventures started, trying to connect the various towns and cities in Great Britain. Such ventures require a huge amount of capital (L&M Railway cost 637000 pounds back then) and best way is to enlist the public's help by issuing stocks. The Bubble Act, which prohibited issuing stocks except through Parliamentary Act or Royal Charter, was repealed in 1825, and the Industrial Revolution have created a relatively affluent middle class with money to invest.

Railroad was the right thing for the marketers by 1845. It was marketed as foolproof and futureproof investment, generating plenty of revenue for decades to come, and latest information avenues such as mass-printed newspapers talked up investments. The British government have very little regulation on this. One just need a sponsor in parliament to introduce the bill authorizing such a line. There was no verification that the company is viable, have proper management, or so on. The company usually offer one of the parliament members a position in the company and stock to ensure the bill gets introduced and more often than not it is passed. Parliament did defeat some rail schemes that claimed to run a line in areas that are impossible to build or run to contemporary technology, but those are rare.

Unfortunately, the lack of regulation and oversight means many of the companies did not even lay down a single mile of railroad, much less operate at a profit to pay back its obligations. People just buy the stocks and forced the prices higher and higher. Furthermore, the railroad companies themselves started lending money to help people buy stocks: just put 10% down and the rest can be negotiated later. By 1846 Railway Mania had reached full swing: over 270 companies were chartered by Parliamentary act that year.

Soon people realized that there can't be that many railways all over the place, and started selling off their stocks. Bank of England also raised interest rates, squeezing money out of railroads, and many railways ran out of funds. Over one third never laid a single mile of track. By 1847 it was all over. Many middle-class fortunes were ruined and savings depleted into the railway mania during this period.

A few properly ran railways started buying up the partially constructed lines at lucrative locations at pennies on the dollar, and the directors of the failing companies, facing bankruptcy or buyout at fraction of worth, usually chose the latter. And those big companies did eventually established lines that added significantly to the British railway system, using lines authorized during the two year railway mania.

[ Read more about the British Railway Mania on Wikipedia ]

Lessons to take away, folks:

- You must always evaluate how sound the actual business is, not how the stock prices are moving

- If there is little to no government regulation and oversight, it is EXTREMELY risky business

- Buying on margin, or other people's money, is extremely dangerous. Margin calls ruined many people, then and now.

The Wall Street Bubble (circa late 1920's)

The US economy enjoyed a decade of prosperity, commonly known as "The Roaring 20's". Businesses are unstoppable. Even Calvin Coolidge was quoted as saying, "Business of America is business." Prices of stocks really went up in 1938. In fact, starting from march 1938 until the big crash less than 18 months later, the rise in stock prices in those 18 months was larger than the increase in stock market in the previous FIVE YEARS. Some corporations, such as RCA, quadrupled in price during those 18 months. Even the most stable business of them all, AT&T, nearly doubled in price during those 18 months.

The stock market was also propped up through "buying on margin", i.e. borrowing money to invest, similar to call options that enabled the Tulip Bulb Craze several hundred years before. In 1929 there were $9 BILLION dollars of stocks bought on margin. People back then paid as little as ten cents on the dollar, the rest were all on margin.

Furthermore, people who know how the market worked is actively manipulating the market, using the earliest forms of "pump and dump" (which was not yet illegal). Even company owners and stakeholders are not immune to this sort of manipulation. Albert Wiggins of Chase Bank sold short his own company's stock and is believed to have pocketed millions.

The Federal Reserve tried to rein in the speculators by raising interest rates, but that didn't stop the speculators, only made them eager to chase BIGGER returns on Wall Street.

By September 1929 the speculation is becoming unsustainable, and prices started to backslide, though in fairly small numbers. This plateau caused many jitterish people to sell, which caused a drop in price, which caused more people to sell. Furthermore, the drop in prices also forced a "margin call", which happens when the prices calls below a certain point where the equity of an investor is below the investment company's guideline, thus requiring the investor to either put in more equity (read: money) or sell off some stocks. Most investors are fully committed with no cash reserves, so stocks are sold, leading to more price drops... which leads to more sell offs... from which there is no return.

The result is the big stock market crash of October 29, 1929, known as Black Tuesdays. 16.4 million shares changed hands that day (remember, this is during mechanical ticker tape days and manual trading, no computers then). Most blue chip stocks dropped 95% in value to less than 10 per share. Even AT&T lost 3/4 of its stock value.

And what happened next, is the Great Depression, when huge loss in fortune in both private and businesses caused full blown economic disaster that is still discussed today.

[ Read more about the Great Wall Street Crash of 1929 on Wikipedia ]

Lessons you're supposed to pick up are:

- Playing the stock market on margin is extremely dangerous, not just for yourself, but for all the other players. Margin calls lead to price drops, which leads to more margin calls.

- People will manipulate the market to their advantage, if they can and there's little penalty to be had

What Could We Learn From Prior Bubbles?

The lessons learned can be summarized as follows:

- Easily available credit such as buying on margin, installment plan, and leverage, often leads to widespread speculation, and in a downturn, cause a negative feedback loop that only made things worse and worse

- People often do not evaluate the business (i.e. fundamental analysis) for its profit potential, but instead, is fixated on the stock price movement, which is fickle and patternless. When it involves objects, the object itself often have little intrinsic value (such as the tulip bulbs).

- People will manipulate the system to their advantage if they can get away with it, even fraudulently. Not even government officials are immune to such abuses.

- Insider trading, pump and dump, and other unethical practices are essentially people cheating the system, and that's unfair to most investors, and must be outlawed as it leads to huge losses

- Investing in an industry or area with little or no government regulation is extremely risky

Conclusion

I hope you have learned a few things, so I will leave you with a quote:

"Those who cannot remember the past are condemned to repeat it"

-- George Santayana, Spanish-American Philosopher

More on Human Mind and Scams

- Four Common Stages of a Scam (internet or not) : tease, please, seize, squeeze, using mystery shoppi

Do you know the four stages of a scam? They are "tease", "please", "seize", and optionally "squeeze". Learn how they work on your risk, cost, and reward perception. - How a Scam Works: distorting your gain, risk, and value perception with words makes you stupid, so b

Do you know the three factors used in cost/benefit equation? It's cost, benefit (also called gain or value), and risk. Learn how a real scam mess with your estimate of those three factors. - Confirmation Bias: What is it, How it affects You, Where do You See it, and How to Deal With biased

Confirmation bias: root of most evils? How your mind traps itself in a circle, and how to get out. - How does a person become gullible and why? How can it be corrected?

What is Gullibility? What makes a person gullible? And how does one go about correcting it? Four factors of gullibility and 8 tactics to decrease gullibility are discussed here.

More Musings on Finance

- Shocking Revelation: Rich Dad is not real, but a myth like Harry Potter, Robert Kiyosaki bluffed! Is

Robert Kiyosaki, the financial writer best known for "Rich Dad Poor Dad", is more of a philosopher and motivator than a financial adviser. Learn why his books should not be taken literally. - Ten Fundamental Rules of Investing (stocks) by Eric Schkolnik EX: never borrow money to invest

Eric Schkolnik's Ten Fundamental Rules of Investing: #1 You Can Lose What You Don't Have (if you Borrow)... Read the rest here. - Warren Buffett's "Inner Scorecard" when it comes to investing: make up your own mind!

What did Warren Buffett say about "inner scorecard"? And how can it help you invest? Find out here. - China's Real Estate Bubble: ready to burst and ruin its economy?

Is the Chinese economy on a bubble ready to burst despite governments claim to be the first nation recovering from the economic slump? A look at their real estate prices says they are ready to bust! Find out why here.